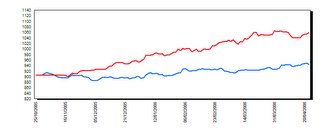

Global Property Fund vs KLCI & Global Equity Fund Benchmark From 25/20/ 2005 To 26/04/2006

Dear all investor,I have generated a few fund's benchmark reports to share with you all.

1.KLCI(Kuala Lumpur Composite Index) VS AmGlobal Property Equity Fund since Inception

BENCHMARK: KLCI vs AMGLOBAL PROPERTY EQUITY FUND(GPF)

Date KLCI aGPF

25/10/2005 904.75 0.00% 0.9429 0.00%

14/11/2005 896.19 -0.94% 0.9429 0.00%

29/11/2005 898.63 -0.67% 0.9605 1.86%

14/12/2005 898.80 -0.64% 0.9767 3.54%

29/12/2005 900.49 -0.45% 0.9973 5.63%

17/01/2006 907.52 0.35% 1.0234 8.23%

07/02/2006 923.84 2.15% 1.0435 10.20%

22/02/2006 924.40 2.21% 1.0548 11.30%

09/03/2006 920.91 1.84% 1.0594 11.75%

24/03/2006 926.09 2.41% 1.0955 15.13%

10/04/2006 942.47 4.17% 1.1027 15.80%

24/04/2006 943.36 4.27% 1.1032 15.86%

Conclusion :Based on the analysis above we can conclude that AmGlobal Property Fund is outperformed the KLCI inception of the AmGlobal Property Fund.AmGlobal Property Fund fully subscribed within 2 weeks time since its first launched.The second Global Property fund launched by Hwang DBS (Hwang DBS Global Property Fund) is selling fast now and only left 95million units left since launched 19 April 2006.It's predicted to be fully subscribed in 2 weeks from the launch date due to the hot demand of Global REIT compared to the Global Equity from the investors.So act fast,before u miss the golden opportunity!!

0 Comments:

Post a Comment

<< Home